© Reuters. AXJO -0.07% Add to/Remove from Watchlist Add to Watchlist Add Position

© Reuters. AXJO -0.07% Add to/Remove from Watchlist Add to Watchlist Add Position Position added successfully to:

+ Add another position Close JP225 -1.77% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close HK50 -0.85% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close NSEI -0.12% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close KS11 -0.13% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close SETI -0.58% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close SSEC -0.09% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close CSI300 -0.24% Add to/Remove from Watchlist Add to Watchlist Add Position

Position added successfully to:

+ Add another position Close

Investing.com-- Most Asian stocks fell on Thursday as persistent concerns over a Chinese economic slowdown kept sentiment dull, while Japanese stocks fell sharply as Bank of Japan Governor Kazuo Ueda discussed options for a potential pivot from negative interest rates.

Investors were also awaiting key U.S. labor market readings to gauge when the Federal Reserve could begin trimming interest rates.

Chinese bluechips near 5-year low, trade data offers little cheer

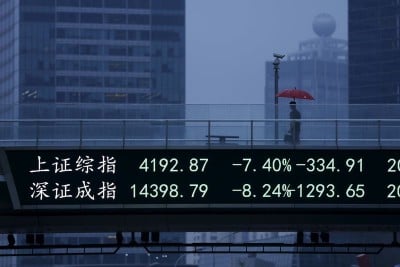

Chinese markets continued to lag their Asian peers, with the bluechip Shanghai Shenzhen CSI 300 index sinking 0.5% to a near five-year low. The Shanghai Composite lost 0.5% and traded at an over one-month low, while Hong Kong’s Hang Seng index slid 1.9% to a 13-month low.

Trade data for November showed little improvement in the Chinese economy. While the country’s trade surplus grew more than expected on a mild recovery in exports, an unexpected decline in imports showed that local demand remained weak.

Sentiment towards China was battered by the threat of a credit rating downgrade by Moody’s earlier this week. The ratings agency flagged increased risks to the economy from a property market meltdown, as well as a lack of clear policy support from the government.

Japan’s Nikkei sinks as Ueda flags challenging times, pivot options

Japan’s Nikkei 225 index slid 1.6% as Bank of Japan Governor Kazuo Ueda said the bank was to face an “even more challenging situation” in December and January.

Ueda also discussed options over pulling interest rates from record lows, reinforcing expectations that the BOJ will end its ultra-loose policies in 2024. A BOJ pivot will bring an end to the nearly decade of easy monetary policy enjoyed by Japanese stocks- which was also a key factor behind their stellar rally this year.

Still, Ueda emphasized on the need for dovish policy in the near-term, citing potential weakness in the Japanese economy.

Broader Asian markets fell tracking weak cues from China, while a negative overnight close on Wall Street provided regional indexes with few positive signals. Markets were largely on edge before a key U.S. nonfarm payrolls reading on Friday, which is expected to provide more cues on the path of monetary policy.

Still, expectations of a less hawkish Federal Reserve had driven stellar gains in Asian stocks over the past month, as markets bet that the central bank will hike rates no more, and begin loosening policy by as soon as March 2024.

Australia’s ASX 200 fell 0.4% on Thursday as the country’s trade surplus grew less than expected in October, with exports, particularly those to China, seeing little improvement.

South Korea’s KOSPI fell 0.1%, while Thailand's SET Index led losses in Southeast Asia with a 0.7% drop.

Futures for India’s Nifty 50 index pointed to a weak open, with the index set to cool after closing at record highs for three consecutive sessions. Focus was also on a Reserve Bank of India meeting this Friday, amid some recent stickiness in Indian inflation.

Upgrade your investing with our groundbreaking, AI-powered InvestingPro+ stock picks. Use coupon INVSPRO2024 to avail a limited time discount on our Pro and Pro+ subscription plans. Click here to know more, and don't forget to use the discount code when checking out!

Asian stocks sink on China weakness, Nikkei slides as BOJ talks pivot